CLOSING COSTS

Things to consider and budget for

Many variables can affect your closing costs. Adjustments will be made at closing in regards to property taxes that have been prepaid such as utilities, taxes, fuel oil tanks and other fees the seller (or buyer) may need adjustments for. These adjustments will be made by your lawyer usually on the closing day (date of completion as outlined in your Agreement of Purchase and Sale).

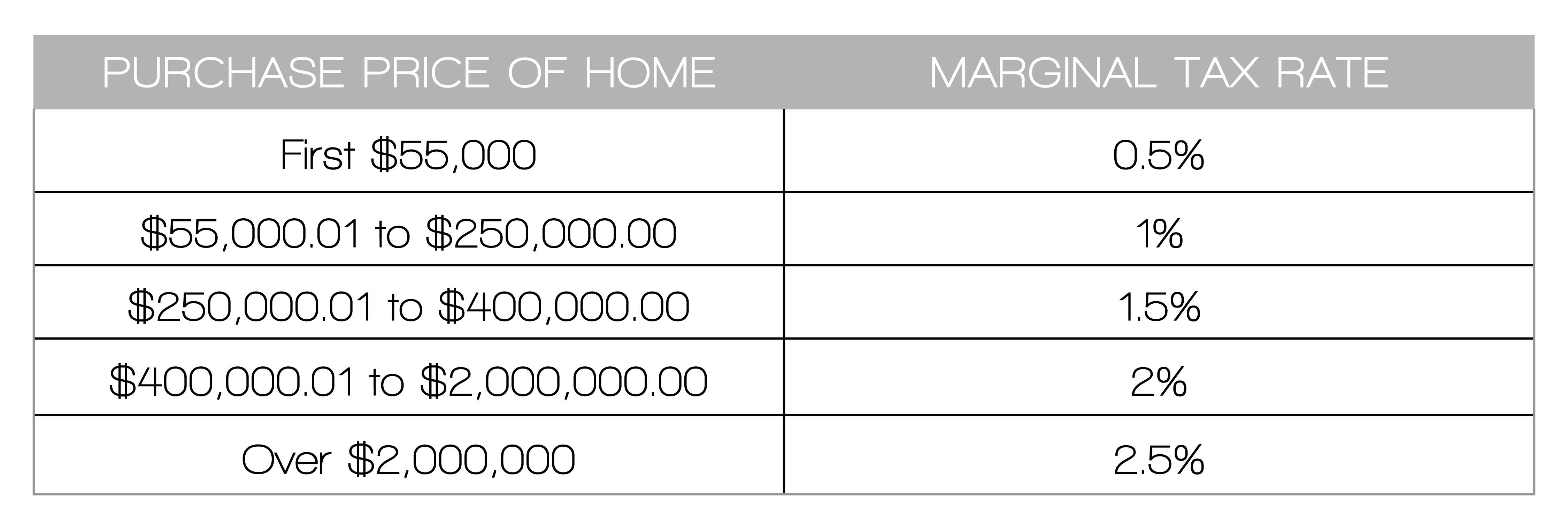

*Single-family and duplex residences only. Land Transfer Tax could be eligible rebates on new homes. Land Transfer Tax

As a general guideline, closing costs are usually 1.5%-2.5% of your purchase price.

Common Closing Expenses:

(all figures are approximate)APPRAISAL FEE

$175.00 – $350.00

HOME INSPECTION FEE

$300.00 – 400.00

LEGAL COSTS & DISPURSEMENTS

$1,200 AND UP

NEW HOME WARRANTY AND TITLE INSURNACE

$225.00 – $850.00

FIRE INSURANCE

$250.00 – $600.00

LAND SURVEY

$600.00 – 900.00

PST & GST

PST 8% OF CMHC FEES IN HIGH RATIO MORTGAGE. GST PAYABLE (NEW HOME PURCHASES)

MORTGAGE APPLICATION AND PROCESSING FEE

$1,200 AND UP